Reunification

For up-to-date information regarding the reunification of Penn State's two law schools, please click here.

For up-to-date information regarding the reunification of Penn State's two law schools, please click here.

May 3, 2018

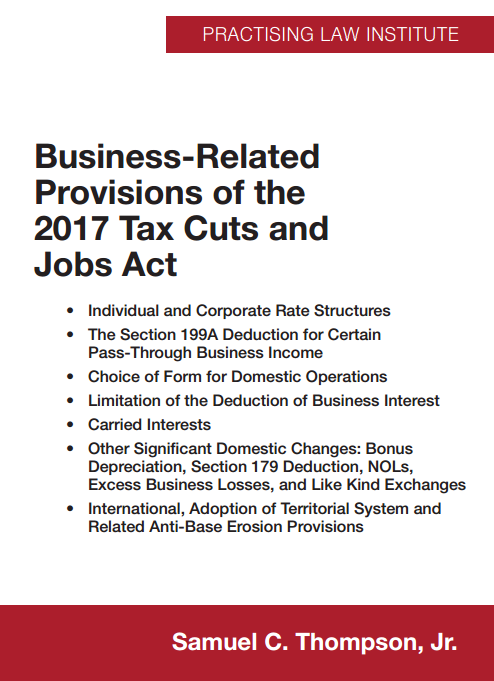

UNIVERSITY PARK, Pa. – A new paper by Penn State Law professor Samuel C. Thompson Jr. describes how certain types of businesses will be affected by the 2017 Tax Cuts and Jobs Act (TCAJA), which was signed into law by President Donald Trump in December. The paper, “Business-Related Provisions of the 2017 TCAJA,” was published in April by the Practising Law Institute (PLI) and can be downloaded for free on the PLI website.

The article introduces the major provisions of the 2017 tax law that will impact the domestic and international business operations of C corporations, S corporations, sole proprietorships, and partnerships. The article also introduces the law’s general tax treatment of individuals, principally as it relates to the rate structure and the business-related activities of individuals.

The article introduces the major provisions of the 2017 tax law that will impact the domestic and international business operations of C corporations, S corporations, sole proprietorships, and partnerships. The article also introduces the law’s general tax treatment of individuals, principally as it relates to the rate structure and the business-related activities of individuals.

The paper begins with the tax law’s individual rate structure changes for both ordinary income and capital gains and then looks at corporate rate structure changes, including the individual tax on dividends and the dividends-received deduction. It also lays out the new section 199A, which provides for a deduction for certain pass-through business income of sole proprietorships, partnerships, and S corporations, and the new limitation on the deduction for business interest.

Thompson provides his “first take” of the law’s impact on mergers and acquisitions and on the choice of form decision for domestic operations. The paper also outlines how the law changes the treatment of carried interest, depreciation, and business losses, among other changes affecting both individuals and corporations. The paper concludes by highlighting several key changes in the international tax arena.

“The 2017 tax law is complex legislation, and it will take time and administrative guidance from the IRS and Treasury for practitioners to fully understand many of its provisions,” Thompson said. “While the goal of this article is to provide a basic analysis of the principal business-related provisions of the law, it is by no means complete. Practitioners should keep a close eye on both administrative developments and the constant flow of commentary on the law.”

Thompson, the Arthur Weiss Distinguished Faculty Scholar at Penn State Law, is an expert on tax and merger and acquisition law. He teaches the corporate, securities, tax, and antitrust aspects of mergers and acquisitions as well as international tax and taxation of business entities. He is the author of 16 books and more than 75 articles on corporate and international tax, corporate governance, securities law, and antitrust law. His five-volume treatise, Mergers, Acquisitions and Tender Offers, published by PLI, is updated twice each year.